Detailed Directions for Finishing Your Online Tax Return in Australia Without Errors

Detailed Directions for Finishing Your Online Tax Return in Australia Without Errors

Blog Article

Simplify Your Funds: Exactly How to Submit Your Online Income Tax Return in Australia

Filing your online tax obligation return in Australia need not be a challenging task if approached methodically. Understanding the intricacies of the tax system and adequately preparing your documents are important first actions.

Understanding the Tax Obligation System

To browse the Australian tax system efficiently, it is important to understand its fundamental concepts and framework. The Australian tax system operates on a self-assessment basis, meaning taxpayers are liable for properly reporting their earnings and calculating their tax obligation commitments. The primary tax authority, the Australian Taxes Workplace (ATO), supervises conformity and implements tax laws.

The tax obligation system makes up various parts, including revenue tax obligation, goods and solutions tax obligation (GST), and capital gains tax obligation (CGT), to name a few. Specific earnings tax is dynamic, with rates raising as earnings rises, while business tax prices differ for tiny and large businesses. Furthermore, tax offsets and reductions are available to minimize gross income, permitting for more customized tax responsibilities based on individual situations.

Knowledge tax residency is likewise crucial, as it establishes an individual's tax obligation obligations. Citizens are taxed on their around the world revenue, while non-residents are only exhausted on Australian-sourced revenue. Familiarity with these principles will certainly empower taxpayers to make educated choices, ensuring compliance and possibly maximizing their tax results as they prepare to submit their online income tax return.

Preparing Your Files

Collecting the essential files is a vital action in preparing to file your online income tax return in Australia. Appropriate documents not just streamlines the filing process however likewise makes certain precision, minimizing the risk of errors that might cause fines or hold-ups.

Start by accumulating your revenue declarations, such as your PAYG payment summaries from employers, which information your earnings and tax withheld. online tax return in Australia. If you are self-employed, ensure you have your business income records and any relevant billings. Additionally, gather financial institution declarations and documents for any type of rate of interest made

Next, assemble documents of insurance deductible costs. This may consist of receipts for work-related costs, such as attires, traveling, and tools, along with any type of academic expenses related to your career. Ensure you have documents for rental revenue and connected expenses like repair services or residential property management costs. if you have residential or commercial property.

Do not neglect to consist of other relevant papers, such as your medical insurance details, superannuation payments, and any type of financial investment earnings declarations. By thoroughly arranging these files, you establish a solid structure for a smooth and efficient online tax obligation return process.

Choosing an Online System

After arranging your paperwork, the following step entails choosing an ideal online platform for submitting your tax return. online tax return in Australia. In Australia, numerous trusted systems are offered, each offering one-of-a-kind functions customized to various taxpayer requirements

When picking an online system, consider the individual interface and convenience of navigation. A simple layout can considerably improve your experience, making it easier to useful source input your info precisely. In addition, guarantee the platform is certified with the Australian Taxes Office (ATO) policies, as this will certainly assure that your entry meets all legal demands.

Systems using online chat, phone support, or comprehensive FAQs can provide beneficial aid if you run into obstacles during the filing process. Look for systems that use file encryption and have a solid privacy plan.

Lastly, think about the expenses related to numerous systems. While some may offer free solutions for fundamental income tax return, others might bill fees for innovative functions or extra assistance. Consider these elements to select the system that lines up best with your economic circumstance and declaring requirements.

Step-by-Step Filing Procedure

The step-by-step filing procedure for your on the internet tax return in Australia is made to improve the submission of your monetary information while making certain compliance with ATO regulations. Started by gathering all needed files, including your revenue statements, financial institution statements, and any kind of receipts for reductions.

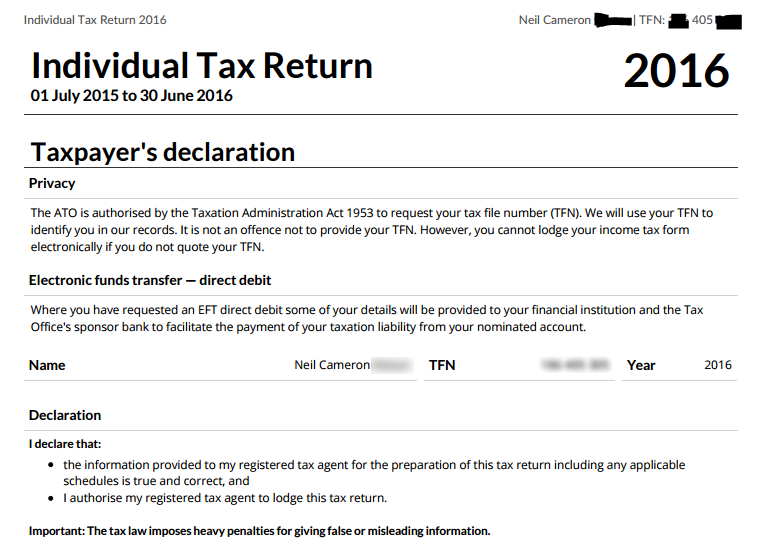

Once you have your records ready, visit homepage visit to your selected online platform and produce or access your account. Input your personal details, including your Tax obligation Data Number (TFN) and call info. Following, enter your income information accurately, making sure to include all income sources such as salaries, rental earnings, or financial investment incomes.

After describing your income, relocate on to assert eligible deductions. This might include job-related expenditures, charitable donations, and clinical expenditures. Make certain to examine the ATO standards to maximize your claims.

After ensuring everything is correct, submit your tax return electronically. Monitor your account for any updates from the ATO regarding your tax return status.

Tips for a Smooth Experience

Completing your online tax return can be a straightforward process with the right preparation and state of mind. To make sure a smooth experience, start by gathering all required files, such as your income statements, invoices for reductions, and any kind of various other appropriate financial records. This company decreases mistakes and saves time throughout the declaring procedure.

Following, acquaint yourself with the Australian this website Taxation Office (ATO) internet site and its on the internet solutions. Make use of the ATO's resources, including overviews and FAQs, to clarify any type of unpredictabilities prior to you begin. online tax return in Australia. Consider establishing a MyGov account connected to the ATO for a streamlined declaring experience

Additionally, make use of the pre-fill performance provided by the ATO, which instantly inhabits several of your info, decreasing the opportunity of mistakes. Guarantee you double-check all access for accuracy prior to entry.

Lastly, enable on your own sufficient time to finish the return without feeling hurried. This will certainly help you keep focus and minimize anxiousness. If issues emerge, don't think twice to speak with a tax obligation specialist or use the ATO's assistance solutions. Following these ideas can bring about a successful and easy online income tax return experience.

Conclusion

In verdict, filing an online tax obligation return in Australia can be structured via cautious prep work and selection of suitable sources. Eventually, these techniques add to an extra reliable tax declaring experience, streamlining financial monitoring and enhancing conformity with tax obligation commitments.

Report this page